does kansas have an estate or inheritance tax

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. New Yorks estate tax.

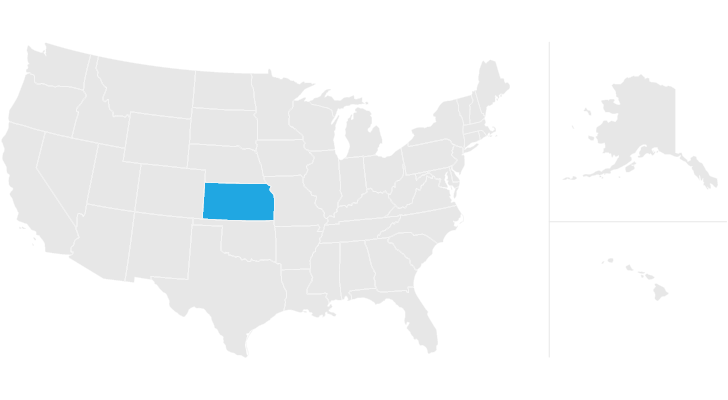

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Many people who are Estate Planning or have had someone die usually have questions about Michigan Inheritance Tax and if they have to pay it.

. Like most states kansas has a progressive income tax with tax rates. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Kansas doesnt have an estate or inheritance tax.

Go this Harrison County Wv Property Tax. If you want to avoid this completely do not reside in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania when you die. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Only six states have an inheritance tax. There is a minimum amount that the estate can be valued at that wont be taxedonce. Skip to content 248 613-0007.

However if you receive an inheritance from another state you may be subject to that states estate or inheritance tax. We have already discussed the fact that Kansas does not have an estate tax. Capital gains are taxed as ordinary income in Kansas.

Inheritance and Estate Taxes. Impose estate taxes and six impose. Unlike an inheritance tax New York does have an estate tax.

Kansas Tax Structure Here are some tax rates and exemptions that you should be aware of. Another states inheritance laws may. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

The state of Kansas does not place a tax on estates or inheritances. The new king will avoid inheritance tax on the estate worth more than 750 million due to a rule introduced by the UK government in 1993 to guard against the royal. Estate Taxes Can Take A Bite Out Of Your Inheritance Income.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax Probate Advance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Estate Tax Everything You Need To Know Smartasset

10 Oldest Cities In The United States Old City City Estate Tax

States You Shouldn T Be Caught Dead In Wsj

Does Kansas Charge An Inheritance Tax

Estate Tax And Inheritance Tax In Kansas Estate Planning

Estate Tax Rates Forms For 2022 State By State Table

Kansas Estate Tax Everything You Need To Know Smartasset

State Death Tax Is A Killer The Heritage Foundation

Oklahoma Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Don T Die In Nebraska How The County Inheritance Tax Works

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance